Do you know why the following payment methods are trending in 2021?

The payment systems industry continues to undergo significant change, something that cannot be ignored in e-commerce. The recent pandemic has also been responsible for accelerating the speed of digitisation.

In Europe, more and more users expect to freely decide how to pay for their purchases, whether through digital wallets, instant transfers, or mobile applications. Knowing and accepting the preferred payment systems of consumers in different countries increases the conversion rate in online stores.

What trends should you take into account in your business?

5 top payment systems in 2021

We could not miss the opportunity to tell you what the most popular eCommerce payment systems are in 2021

In this post, we look at the present and future of the most widely used payment systems from a global perspective.

1. Invisible payments

Invisible payments are forms of payment made without the use of cash or credit cards. How is this possible? Thanks to technical developments in payment systems based on voice recognition or facial biometrics. Many mobile devices can now be unlocked by simply putting your face in front of the device’s screen.

This widely accepted use of biometrics in mobile has been the technical basis for developing face-to-pay payment solutions. As a result, the purchase process is streamlined, security is enhanced, and the customer experience is improved. Very soon, face-to-pay could be available in stores and for different methods of transport in Europe and the rest of the world.

Some examples of companies already using such technology include the Vienna hospitality group and Payment Innovation, AliExpress, and Smile-to-Pay.

2. Omnichannel payments

Many people tend to get omnichannel strategies and unified commerce mixed up. While the former seeks to integrate all contact channels, the latter aims to integrate all business management into a single digital platform.

Unified commerce allows retailers to provide a modern and seamless shopping experience based on the omnichannel sales model. Not only does it reduce shopping cart abandonment, but it also increases flexibility and enables one-click payments.

In a few words, an omnichannel payments platform is a complete solution for payment processing. It embodies all the business’ payment processes together, giving a unique glimpse of your customer. Utilised accurately, it can deliver a personalised and pleasant customer journey across any shopping channel.

Retailers have realised that the best way to offer different payment methods to their customers while surviving an increasingly digitised market is through eCommerce. In their regular tasks, they collect a large volume of data at different contact channels, from social media to surveys to POS. And that is fine, but it brings the new need to organise, analyse and transform this data into valuable information.

The answer to this problem lies in unified commerce through payment gateways. Why use different tools when you could manage your business from a single platform?

3. eWallet Apps

These are electronic wallets that allow the same features as a physical wallet. Among their main advantages, we find: ease of use when paying for a purchase thanks to NFC technology (Near Field Communication); the easy digitisation of payments; time and cost savings in invoicing; making payments without the need to carry cash or credit cards; etc.

Between 50% and 80% of the banked users who are also internet-users have installed the application of their main bank and use it frequently, according to the latest data collected in the Minsait report.

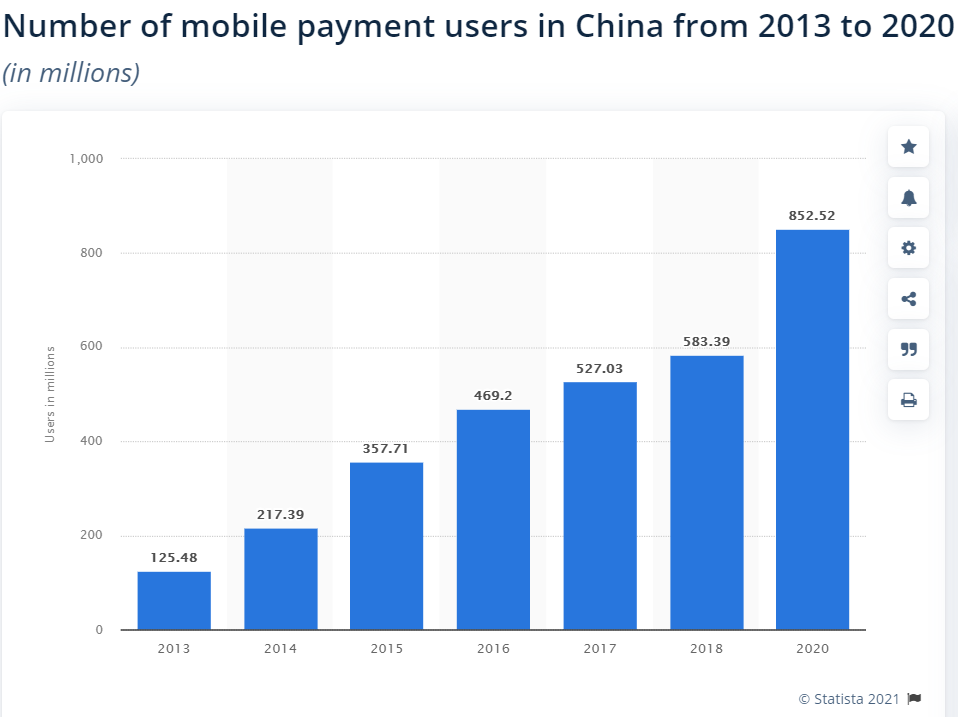

In recent years, in the most heavily banked populations, such as in China, the number of mobile payment users has increased from 583 million in 2018 to 852 million in 2020. Digital payments are becoming so predominant that people have moved shortly from a card-based financial model to one dominated by e-wallets.

For example, Alipay and WeChat made smart choices by introducing e-wallets into their apps. They’ve created a solid customer-value proposition by deploying payments not as an end in itself but as a gateway to a vast digital ecosystem of products and services.

Source: Statista

4. Tokenised card payment

Card payments are one of the most widely used payment methods worldwide and allow purchases to be made and paid for with an identifier linked to the buyer’s account. Card tokenisation is a dynamic component that can be added to this type of payments, a payment security method increasingly implemented in eCommerce due to the advantages it offers: security, trust and ease.

Tokenised payments protect the PAN number under an encryption system that issues a unique code with digits (token) that replaces the PAN during the transaction. In this way, if a user makes a payment through a tokenised payment service, the data sent to the card network is a token instead of the cardholder’s account details. This is undoubtedly one of the best data protection systems to integrate into the e-payment ecosystem.

5. Mobile payments

They are payments or financial transactions made through mobile devices, such as a smartphone or a tablet. Thanks to the development and widespread use of smartphones, specialised payment applications have emerged, speeding up processing times and implementing new security measures.

Payments through mobile applications continue to rise today and have drastically impacted the behaviours of brands and consumers. The report Global Mobile Payment Users Report from eMarketer has found that around 92.3 million people aged +14 are the major users of mobile payments in the U.S. The same phenomenon occurs in Spain, where 74% of consumers aged 18-35 are very confident to pay with their smartphones.

According to a recent study from Juniper Research, the number of unique e-wallet users will exceed 4.4 billion globally in 2025. The research also shows that e-wallets lead about 70% of the growth as mobile payments expand across markets.

Also, the study has revealed that QR code payments will account for 40% of all e-wallet transactions globally by 2025. It is increasingly common in countries such as China to pay using QR codes or links. AliPay and WeChat have wholly changed payment in taxis, supermarkets, and all kinds of stores using QR-code payments. The same goes for India, where RuPay has initiated a modern way for merchants and buyers to exchange funds using a QR Code-based interface, making it a favourite channel for streamlining and increasing electronic payments.

What happens when a user cannot choose their preferred payment method?

Let’s say you own an online sportswear store in Spain, and you sell products to different EU countries. Among them, Belgium, Germany and the Netherlands. The most popular payment methods in these countries are different, so the preferences of your Belgian, German and Dutch customers when paying for their online purchases will be different as well.

Do you think the best option is to offer a single payment method for all? Or should you opt for a global payment system with different integrated payment methods depending on the country?

It would be best to go for this second option, with a payment gateway that integrates different payment methods tailored to the local preferences of your customers. For example, iDEAL for Dutch consumers, Bancontact for Belgian users, and Klarna (Sofort) for Germans. With this payment system, you will charge your customers via the methods they are familiar with and trust. For your business, this means more sales, more conversion, and a better user experience.

When this is not possible, around 70% of consumers cancel their orders and abandon their shopping cart, according to the D/A Retail eCommerce 2020 report.

If you have any questions, call us. At PayXpert we are waiting for you.