In today’s increasingly competitive global market, merchants continually seek new growth opportunities, particularly in expanding into the Asian market. Asia stands out not only as one of the fastest-growing economic regions globally but also boasts a vast consumer base and a mature mobile payment ecosystem. Alipay+ serves as a crucial bridge connecting European merchants with Asian consumers.

What is Alipay+?

Alipay+ is a global cross-border payment and digital solution launched by Ant Group in 2020. It is designed to help global merchants easily connect with Asian consumers. Unlike traditional payment methods, Alipay+ aggregates about 30 Asian e-wallets, including the main wallet, Alipay (China), through one single integration, supporting mobile payments across various countries and regions.

Source: https://www.alipayplus.com

In addition to providing payment support, it also offers marketing solutions to help merchants effectively reach and attract Asian consumers.

The potential of tapping into the Asian market

1. Massive user base and spending power

Asian consumers are highly receptive to mobile payments, with usage rates noticeably exceeding the global average. Countries and regions like China, Southeast Asia, and South Korea have substantial user bases for local e-wallets. For instance:

- China: Alipay has 890 million active users monthly.

- South Korea: Kakao Pay, with approximately 39.4 million users.

- Japan: PayPay, with over 62 million users.

- Thailand: TrueMoney, with more than 30 million users, and LINE Pay, with a monthly active user base that accounts for 85.4% of Thai internet users.

- Philippines: GCash, with 81 million monthly active users.

- Indonesia: DANA, growing from 150 million users in 2023 to 180 million in 2024.

- Malaysia: Touch ’n Go eWallet, with over 20 million verified users serving more than 200,000 merchants in Malaysia.

2. Growing opportunities in the tourism market

The Asian consumer market is rapidly expanding and becoming a significant growth driver for the global tourism industry. By 2025, India will add 47 million new consumers, outpacing China’s 33 million. Additionally, emerging economies such as Indonesia, Bangladesh, Vietnam, the Philippines, and Pakistan will contribute 19.5 million new consumers, further driving regional economic growth and international tourism expansion.

Data shows that outbound tourism in the Asia-Pacific region grew 35% year-on-year from January to September 2024, significantly higher than Europe (9%) and the Americas (18%). This reflects the strong recovery in Asian consumers’ demand for international travel and improved air connectivity and visa facilitation.

3. Mobile payment dominance

Mobile payments dominate the Asian market, with consumers preferring local e-wallets over traditional credit cards or cash. The adoption rate of mobile payments in the Asia-Pacific region far exceeds the global average. E-wallets account for 60% of the Asian market, compared to the worldwide average of 44%, highlighting their deep integration into consumers’ daily lives. Aligning with the “mobile-first” behaviour of Asia consumers and adapting to their payment habits is key to business.

Why Choose Alipay+?

1. One integration to reach multiple countries

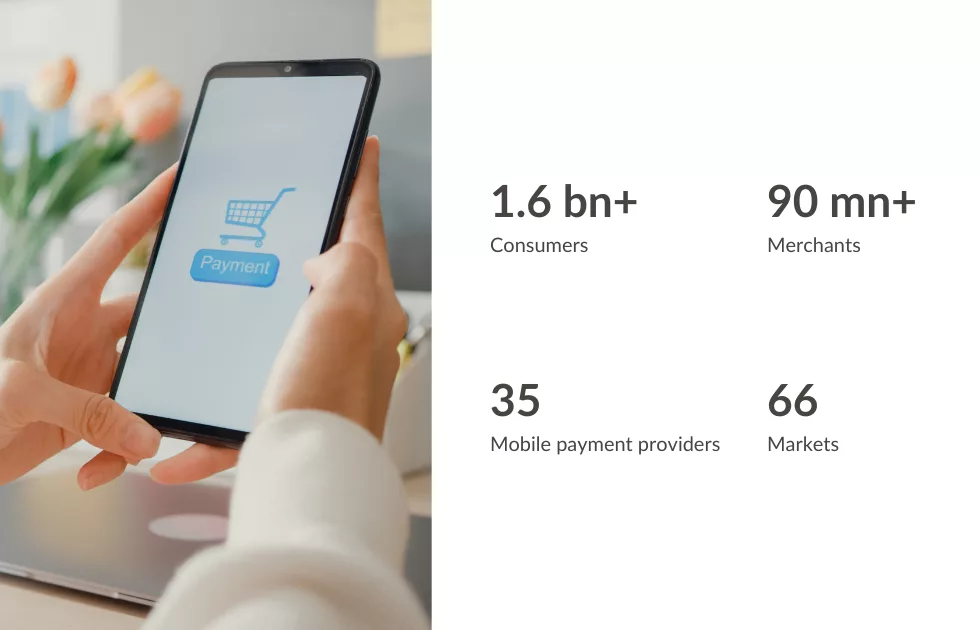

Merchants can accept payments from local e-wallets in various countries and regions with just one integration, saving investment while reaching a more significant consumer base of over 1.6 billion.

2. Higher conversion rates

Consumers feel more comfortable using familiar payment methods, leading to better customer experience and higher conversion rates.

3. Enhanced brand appeal

Offering Alipay+ payment services can significantly boost a brand’s recognition among Asian consumers, enhancing its competitiveness.

4. Easy settlements

Alipay+ supports local currency settlements, allowing merchants to receive payments directly in their l currencies without additional hassles.

5. Marketing capability

In addition to payments, Alipay+ also empowers merchants with marketing solutions that integrate payment flows with customer engagement tools. Through its app, brands can deliver targeted promotions such as location-based discounts for travellers and promotions, for instance, payment rewards sponsored by the acquirer, boosting conversion and encouraging spending. Moreover, the platform enables cross-border campaigns via partnerships with Asian e-wallets, allowing merchants to deploy unified promotions across multiple markets.

Conclusion

For European merchants aiming to expand into the Asian market, integrating with Alipay+ is not just about completing the payment package but also a crucial step in connecting with Asian consumers. With the recovery of international tourism and growing cross-border e-commerce, providing consumers with trusted and preferred local payment methods will become a key competitive advantage for merchants in attracting consumers and transforming transactional touchpoints into long-term loyalty drivers.

Contact us today to align your expansion strategy with Asia’s digital-first consumers and unlock untapped revenue streams!

*Payxpert Ltd. is payment institution regulated by the FCA and licensed in the United Kingdom. Payxpert Services Ltd. is a subsidiary of the Société Générale Group, and the sole onwer of Payxpert Spain SL and Payxpert France SASU. Payxpert Spain SL is a payment institution regulated by Banco de España and licensed in Spain, with an EU passport to provide services in several countries of the European Union.