Offering online products and services can be a great opportunity for a Merchant.

When considering to move into the e-commerce world, or simply when directly creating a webpage, Merchants need to a clear vision of the goals they intend to reach and the willingness to reach them. When creating a business model based on e-commerce Merchants need to consider a lot factors such as financial stability, risk exposure, payment strategy, business plan, marketing costs, etc, etc.

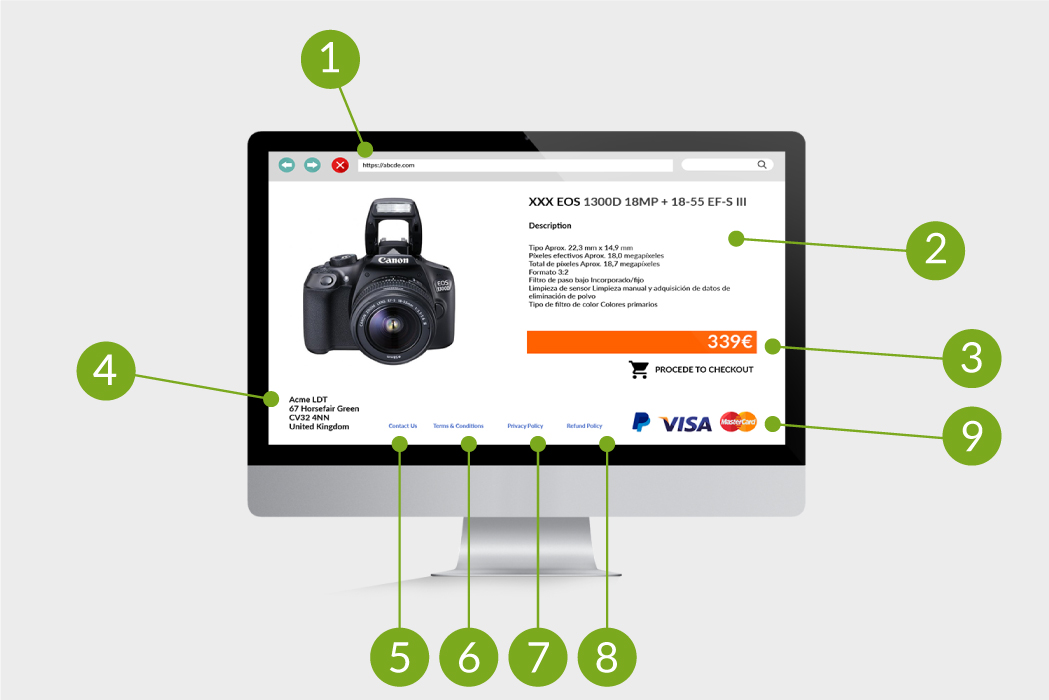

Obviously the business card Merchant present to the world is the website: through this combination of descriptive pages, appealing themes, good quality images, excellent meta descriptions tags, optimized strategies for SEO and SEM they aim to offer the best customer experience and have in return the best conversion rate.

When we talk of e-commerce Merchants consider many elements, but there are some requirements that they need to comply when setting up an ecommerce site. As we know an important partner of the Merchant is the payment gateway, that offer them the possibility to offer payment method to their customers. Behind the payment gateways there are the Card Brands (Visa, Mastercard, American Express, etc) that with the help of the acquiring banks makes it possible to accept transactions over the internet.

Brands have set a series of requirements that Merchants need to comply in order to be able to be granted a business account.

Below you can find all requirements you must have:

1. Have a Secure Check Out page

Seems basic but in order to sell product online Merchant need to have a secure check out page. This is done by enabling in the domain the SSL (Secure Socket Layer) Certificate, that once is installed it activates the padlock and the https protocols and allow secure connections from web server to browser. Main advantages of the SSL certificate are:

- Keep data secure between server

- Build or enhance customer trust

- Improve conversion rate

- Increase Google Ranking

Currently the majority of the platforms for websites content management (WordPress, Joomla, Tumblr, etc) offer this solution easily and cheaply.

If the Merchant hosts their own payment page they need also to be PCI Compliant to properly protect the customer credit card details.

2. Clear description of the product

This is also very important. The website must include an exhaustive description of the goods or service provided. This is a requirement for the following reasons:

- Avoid misunderstanding or miscommunication: for instance, if you sell electrical goods make sure to state the voltage requirements, that can differ around the world.

- Prevent chargebacks: Customer can claim they received a good or services “not as described” in the webpage if the description contains crucial omissions or inaccuracies.

3. Price of the product including currency

The price of each product or service must be indicated clearly. Also, additional costs must be stated. Only VAT (if applicable) and any transportation and delivery costs can be excluded but must be shown at the final stage of the check out process, but before that payment is made. The payment currency is also mandatory to avoid misunderstanding or miscommunication.

4. Full Company details including country of incorporation

Merchant must display at all time all references related to the company, including name, address and incorporation country. This can be done in two ways:

- By simply reporting the company details on the footer of the webpage

- By including a legal notice: this is a brief explanation of the Merchant activity

Brands require that the company details are always displayed on the checkout page and that the address is displayed for cardholder correspondence.

5. Company contact details

Merchants must offer and display contact details where customers can refer to in case they need assistance. Merchants must indicate the way customer can reach them (phone, e-mail, chat, postal address) and if applicable the business hours of customer support availability and associated costs (for phone calls mainly).

6. General Terms & Conditions

The Terms and conditions define the contractual terms that apply to purchase made in the Merchant shop and define all the clauses related to the business relationship between the Merchant and the customer. Having a clear Terms and Condition will reduce the possibility of receiving chargebacks. Terms & Condition should contain at the very least :

- Definition of the purpose of the website

- Payments methods offered and terms of use

- If any guarantees or warrantees are offered

- Delivery time for regions that are serviced

- Limitation of liability

- Length of the contract and how to end the relationship

- Jurisdiction that govern the contract

Good Terms and Conditions should be tailored to the type of business and should be considered a way to protect both sides.

7. Privacy Policy

In an age where data protection is a major concern for Government and Institutions, Merchant should indicate very clearly how they collect, use, disclose and manage client data. Merchant must offer the customer the possibility to access, update, erase, restrict, objection and manage their data.

8. Refund Policy

The return, refund and cancellation policy must be clearly stated in the Merchant website. Most of the Merchants include this part in the General Terms & Conditions but brands recommend having a dedicated section in the website to deal with return and refunds. Merchant must indicate the period of validity of the refund or cancellation, that should adhere with local legislation, and specify policies for return.

About PayXpert:

PayXpert is a payment provider company, licensed for Europe through the UK Financial Conduct Authority.

We are a company with a young, multicultural and dynamic team, striving to bring its payment experience and know-how to both existing and potential partners. Founded in 2009, PayXpert has expanded its presence to UK, Spain, France, Germany, Italy, Taiwan, The Netherlands and Switzerland. Thanks to a large network of acquirers, PayXpert can process in over 180 currencies and offer settlement in 20.