E-commerce is marking a turning point in the ways of buying and selling our products: buyer and seller are the protagonists of this story, the Internet is the stage and payment systems represent the activity verifying the purchase or sale.

However, technological advances are playing a fundamental role in the activity of e-Commerce and consumer habits. Nowadays, having an online business is ceasing to be an option to become a must for companies due to several reasons: they need to be present where their clients are, as well as to increase national and international competitiveness. The occurrence of Internet fraud and its detection is one of the great challenges of electronic commerce. Therefore, increasing attention is being paid to payment systems used in it and two premises must be taken into account: the type of business and to whom it is directed.

Do you receive daily purchases from clients in different countries of the world, where payment methods, characteristics and fraud are not the same?

We will tell you in this post what Virtual POS is and why you should implement it as a payment alternative in your e-Commerce.

What is the Virtual POS?

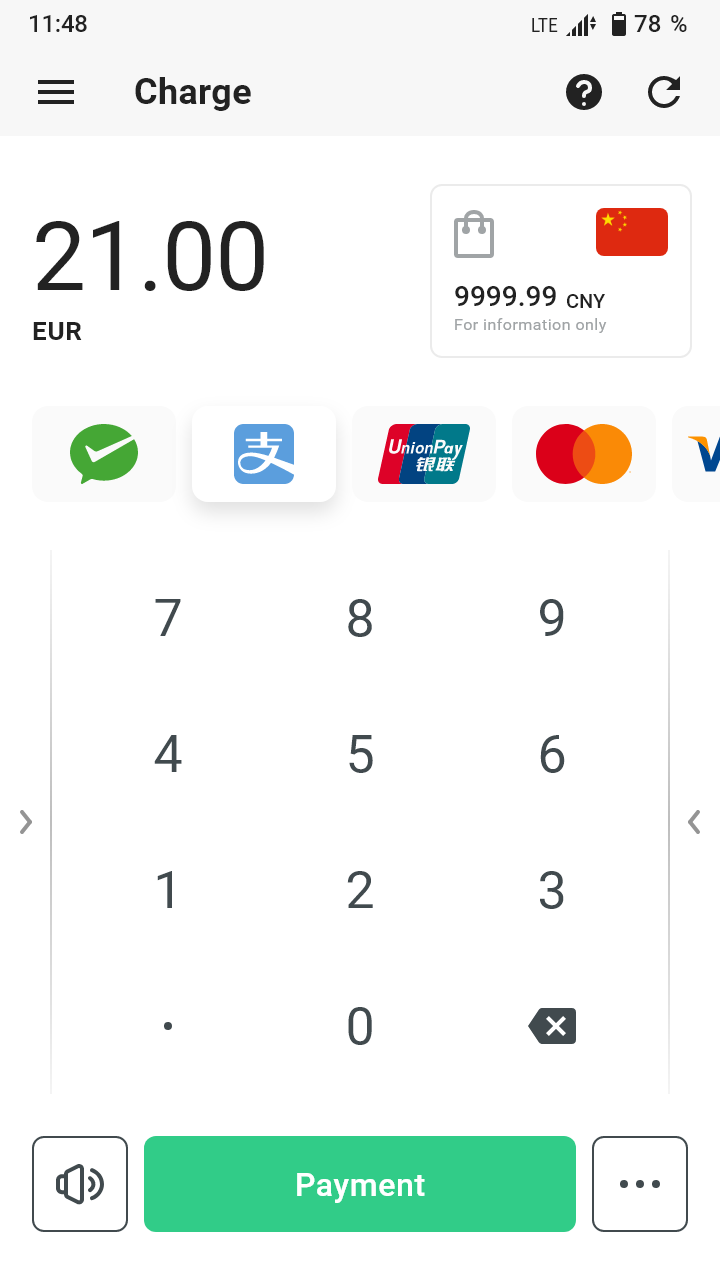

The Virtual POS is a system that allows e-Commerce to accept payments from consumers through credit or debit cards. Some of its main features are: operations through certain platforms with different payment gateways, acceptance of card payment after entering our data (MasterCard, Visa, American Express…), guarantee of data security and role as an intermediary between the e-Commerce and the client.

Advantages of having a Virtual POS in online business

Today more than ever, we have to make things easy and accessible to clients, who are increasingly demanding and, in addition, competition continues to grow. E-Commerce has become an alternative meeting these characteristics and constitutes a fundamental part of the economy in Spain and other countries. Many companies arise directly as online businesses, and other physical stores have their digital version to increase their possibilities and attract potential customers.

The Virtual POS has a series of advantages for e-Commerce:

- Your customers will buy products quickly and easily.

- It is a highly secure process.

- The activity is entirely online and does not require installing any type of software.

- It accepts payments with a large number of cards.

- Charges are received instantly.

- Default risk is much lower

Thanks to the online payment tool Virtual POS (Point of Sale Terminal), digital business models can make their sales immediately through the Internet. The world of e-Commerce includes the sale, distribution, marketing and information of all products sold via the Internet, and especially, the care and attention regarding the methods used when charging.

Evolution of payment systems in e-Commerce

If we take a look at the data of the National Commission on Markets and Competition, “in 2018 e-Commerce invoiced in Spain about 40,000 million euros and expectations placed the figure above 50,000 million in 2019”. The reasons for this unstoppable growth result from:

- Democratization of the Internet. There are more and more people connected to the Internet and users with mobile devices.

- Implementation of new payment methods. Users use convenient and safe payment methods to buy.

- Interface improvement on online business platforms. Digital stores are increasingly intuitive and user-friendly.

According to data collected by the INE (National Statistics Institute) in 2018:

- “In Spain, the most widely used way to pay online is the credit or debit card for 72.4% of people”.

The evolution of online payment systems has enabled a consolidated commitment to electronic commerce without fear of fraud. Throughout this post we have talked about the Virtual POS, but there are other options allowing e-Commerce to adapt to the needs of its national and foreign clients:

- Payment gateways with specific alternatives adapted to tourists who visit our online shops, such as WeChat, Alipay or MIR, quite popular with Chinese and Russian visitors. Moreover, they also allow other possibilities, such as payment automation through the implementation of IVR (Interactive Voice Response) and other services. Payment gateways are today one of the most complete solutions to manage sales and reduce fraud risks in e-Commerce.

We cannot forget the development of cryptocurrencies and the use of Bizum, two systems that have facilitated the payment of customers from their Smartphones.

The development of new digital payment platforms does not eliminate existing traditional methods for now. In fact, bank transfers continue, but its main drawback is the lack of speed in the process. The same happens with direct debits, to which credit and debit cards have been gaining ground.

The future of payment methods: beyond the Virtual POS

The technology and evolution of payment systems in online stores are two scenarios going hand in hand. The fact is that clients research, search for and compare prices and products over the Internet. Everything indicates that the future of online payments in e-Commerce will be an omnichannel model, with control panels from which to monitor sales, consumer behaviour and business performance in general.

Some payment gateways, both online and at POS, already include different methods, such as additional Dashboard services to analyse all transactions and optimize rejected operations, and a great deal more.

Are you betting on the future of your e-Commerce?