The rapid growth in digital transactions will continue to heavily influence businesses using payment systems throughout 2021. Unified Commerce and eCommerce will be hot topics this year for the anticipated retail-to-online digital transformation boom. That’s why PayXpert focuses on keeping its products and services up to date with the best cms platforms, fintech apps and payment gateway features, with technologies that enable our merchants to sell products via omnichannel and much more.

Announcement: PayXpert and 365 Business Finance alliance to provide merchants with access to easy and high-quality financing

The current Covid-19 pandemic economic environment has forced many businesses to adapt and to go into a defensive mode. If SMEs were in need of accessible financing before this crisis, now that need has exploded. At PayXpert we felt we could help our merchants more, by adding a new partnership to our extensive ecosystem.

365 Business Finance is a direct financial provider, offering a merchant cash advance product to small and medium-sized businesses across the United Kingdom that are looking for unsecured business funding of up to £200,000. There are no fixed terms, repayments or APR.

A merchant cash advance is designed as a quick way for any business that accepts credit and/or debit cards to raise capital. This type of funding is a fast flexible alternative to a bank loan or overdraft.

365 Business Finance funds businesses in the UK, advancing SMEs funds enabling them to undertake development, purchase stock, settle unexpected bills or any other business need they may have. The flexible repayments offered by 365, which see repayments done through a percentage held on credit and debit card sales, have proven popular amongst SMEs looking to protect their cash flow.

What will the alliance mean for my business?

PayXpert and 365 Business Finance will work together at the card terminal level, allowing for an extremely smooth merchant cash advance application process that does not require the submission of a business plan. Almost 90% of all applications will provisionally be approved within 24 hours.

With a strong team of funding specialists on hand, each applicant will be allocated a dedicated funding specialist to help them through the application and ensure the finance is approved and available in the quickest time possible. We hope this will help during these difficult to navigate times.

So, get in touch with us at sales@payxpert.com or your assigned Success Manager for more information on Cash Advance Products for SMEs at PayXpert.

Developer’s corner: PayXpert Plugin for Prestashop 1.7 updated

Our development team has worked hard this month on updating our payment gateway plugin for Prestashop. These are the PayXpert Plugin for Prestashop v1.1.2 updates:

New payment methods are now supported

You can now process these alternative payment methods with Prestashop:

- WeChat Pay,

- Alipay,

- Giropay,

- Sofort,

- Ideal,

- Przelewy24 (P24)

Seamless Checkout

You can now have a Seamless Checkout in your Prestashop store! Seamless Checkout is a beautiful way to increase your sales and conversion by making the payment process short and sweet directly from your product or checkout page. Check out what seamless checkout is and what it can do for you, or go to our documentation to learn more about integrating it in your Prestashop store.

Other News

UK Headquarters Change of Offices

We would like to notify you of our new office location and address in London. Effective from 29th March 2021, the new PayXpert LTD address in the UK will be:

199 Bishopsgate

London, EC2M 3TY

United Kingdom

If you have any questions or need clarification, please do not hesitate to contact us at support@payxpert.com.

Discover and UnionPay direct agreements mean payment freedom

We have been approved to become a UnionPay and Discover acquiring bank, meaning great new advantages for our merchants – integrations are already planned to start soon.

The current Covid-19 pandemic encourages digital payments and e-commerce over cash and physical transactions. In turn, this boosts opportunities for cross-border sales for businesses across the board… and that is where additional payment options for customers such as Discover and UnionPay come in.

One of the world’s leading payments partner, Discover, and one of the biggest payment schemes in China, UnionPay, are broadening their future collaboration with PSPs like PayXpert. Merchants can enjoy the advantages of accepting Discover and UnionPay payments with direct agreements from the payment’s giants.

UnionPay

UnionPay International (UPI) is a subsidiary of China UnionPay focused on the growth and support of UnionPay’s global business. In partnership with more than 2400 institutions worldwide, UnionPay International has enabled card acceptance in 180 countries and regions with issuance in 68 countries and regions. UnionPay International provides high quality, cost-effective and secure cross-border payment services to the world’s largest cardholder base and ensures convenient local services to a growing number of global UnionPay cardholders and merchants.

Discover

Discover is a credit card brand issued primarily in the United States. It was introduced by Sears in 1985. Discover is the third-largest credit card brand in the U.S. based on the number of cards in circulation, behind Visa and MasterCard, with 57 million cardholders, and it is the fastest-growing global payment network.

With 189+ Million global cardholders Discover processes billions in global transaction volume from all the cards that leverage the Discover global network, including Discover® Card from the United States, Diners Club International®, and 18 Network Alliances from around the globe.

What will direct agreements mean for my business?

Future plans for Discover and UnionPay integrations, with the direct agreements, means:

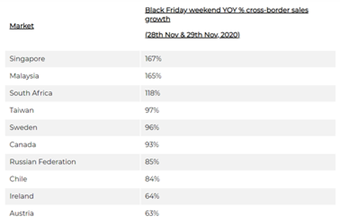

- Increased cross-border conversion rates with international customers

- You can enjoy a direct connection to Discover/UnionPay with no system downtimes during peak shopping seasons, such as Black Friday or Christmas. Cross-border sales are increasing at a huge rate YoY, with peaks of 545% growth in global cross-border in 2019

- You can take advantage of easier reconciliation operations and cleaner data flows in our Backoffice.

There has never been a better time to do business with PayXpert. So, get in touch with us at sales@payxpert.com for more information.

Industry Recognition

Raul Sanchez @ Digital Transformation

Raul Sanchez, our Iberian Regional Manager made a presentation about the EU to China commercial opportunities rising, at the Digital Transformation for the Retail Industry event from Urban Marketing. After making an amazing presentation, he joined a panel of experts to discuss the topic at the same event.

David Armstrong @ Pay360

David Armstrong, our Managing Director, presented our company and solutions for an expert audience at Pay360, an Emerging Payments Association and Mastercard extremely popular annual event.

3DSv2? No problem!

We are proud to inform you that our 3DSV2 roll out with European Acquirers continues to advance smoothly. We will keep you informed of any new developments of interest related to the implementation of this enhanced security standard.