Technical Release Overview

What does 2021 hold for tech at PayXpert?

To start the year off right, developing and improving our payment products and services will be our focus. Our drive is to offer better partnerships, more practical functionalities and product compliance. At PayXpert, we know that our reliable payment services make us the right partner for 2021 and beyond.

All the best this year in your upcoming business endeavours!

Backoffice tips: More statistics options

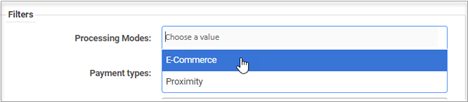

January 2021’s release includes better ways to view your statistical data in the PayXpert Backoffice. Now you can divide Ecommerce from Proximity (POS device) operations.

Go to the backoffice. Enter the Statistics area as before. Go to the Filters > Processing Modes and choose what works for you. Then, continue programming any other relevant fields to your statistics.

Detail of Processing Modes drop-down options

Remember, you can save statistical searches as Pre-defined Statistics to save time.

Coder’s corner: API first

A hot trend in API development is the API first approach. But what does it mean for developers on the ground? This approach implies that the API is given top priority in any given dev project. Everything about a project revolves around the idea that the end product will be consumed by mobile devices, or online platforms and that client apps will consume APIs.

A hot trend in API development is the API first approach. But what does it mean for developers on the ground? This approach implies that the API is given top priority in any given dev project. Everything about a project revolves around the idea that the end product will be consumed by mobile devices, or online platforms and that client apps will consume APIs.

In this process, teams ask themselves questions like “if this capability was available, what would the API look like?”. It is both simple and avant-garde, and can be summed up in three straightforward principles:

- The API is the first thing to design for each service being built. User interfaces may be relevant, but they are secondary and must be built on the API.

- The API needs to be released and discussed before implementation starts. That means all implementation efforts can be focused on an API design that has been vetted and discussed.

- The API is the primary representation of a capability, so its documentation is essential to help users understand and utilise the capability.

An API-first approach and IT infrastructure modernisation in payment gateway solutions are highly advantageous for both the private and public domain undergoing digital transformation.

Speed to market

Much of the process of building APIs can be automated using tools that allow the import of API definition files. With those files, API tools such as API documentation, SDKs, and mock APIs can be auto-generated as a result. Automation plays a crucial role in speeding up API and app development.

To sum up, API first is an approach that revolutionises our development projects at PayXpert. Its framework is designed to build better products, which is always a driving factor in Fintech dev. We don’t just want to build a connection to a payment platform or acquirer bank. We want to create solid dev for better payment choices for end consumers.

FAQs for APIs

What is the difference between Synchronous and Asynchronous payment methods?

Synchronous payment methods

With a synchronous payment method, the charge request’s status can be immediately confirmed as either “succeeded” or “failed”. If the charge request is successful, the payment is completed—it’s considered guaranteed that the customer has been charged and that merchants will receive the funds. Credit card payments are an example of a synchronous payment method with real-time confirmation of the payment’s success or failure.

Asynchronous payment methods

On the other hand, it can take up to several days for asynchronous payment methods to confirm whether the payment has been successful. During this time, the payment cannot be guaranteed. The status of the payment’s “charge” object is initially set to “pending”… until the payment has been confirmed as successful or failed. WeChat and Alipay QR payments are an example of an asynchronous method: with these debits, it takes time between the systems to confirm that the payment was successfully completed.

Why this matters at PayXpert

As such, PayXpert developed an Alternative Payments API to connect to our Payment Gateway that funnels information to our Payment Central interface. Thanks to this integration, PayXpert now runs synchronous data operations between our system and WeChat’s and Alipay’s backend systems. The end result is WeChat and Alipay merchants can see confirmation of payment in the PayXpert backoffice without delays.