The rapid growth in digital transactions will continue to heavily influence businesses using payment systems throughout 2021. A new wave of consolidation may further drive disruptive technologies and customer demand for both online and contactless payment methods. NextGen POS technology will be a hot topic this year for the anticipated in-shop payments ramp up. That’s why PayXpert focuses on keeping its products and services up to date with mobile payments, fintech apps and payment gateway features, with technologies that enable our merchants to sell products via omnichannel and much more.

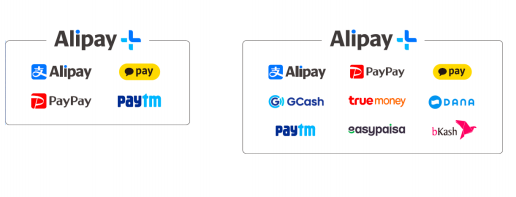

Announcement: Alipay+ offers multi-wallet opportunities

The current Covid-19 pandemic encourages contactless payments over cash. In turn, this boosts opportunities for e-wallet, QR-code and online payments for businesses across the board. That is where alternative payments like Alipay+ come in.

One of the world’s leading Chinese payments methods, Aliplay is broadening merchant opportunities with the launch of the Alipay+ package, now available at PayXpert. Merchants can enjoy the advantages of accepting the multiple e-wallet payment methods Alipay+ has to offer.

What will Alipay+ mean for my business?

The Alipay+ package, available through PayXpert alternative payments, means:

You will enjoy automatic integration and access to the package with no system downtimes. Boost purchases from returning Chinese consumers and in future peaks shopping seasons.

There has never been a better time to go contactless and do business with PayXpert. So, get in touch with us at sales@payxpert.com or your assigned Success Manager for more information on Chinese payment news at PayXpert.

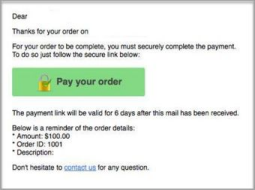

Backoffice tips: Payment by email mode

Once you have your payment page set up with PayXpert, you can take advantage of the Payment by email mode. In this option, a link is emailed to the cardholder to manually enter their payment details. All fields are blank, except for the amount. Meanwhile, the Order ID appears having been automatically inserted by the system.

If the payer does not wish to give credit card details over the phone, or you are running an e-commerce site, this represents a safe, effective solution.

How does it work?

The payer receives an email. They only need to click the green button to proceed with their purchase.

Meanwhile, all information on your current and past Payments by email are viewable in the backoffice. Just log

into central.payxpert.com and go to Processing > Payments by E-mail to view or filter your results.

Developer’s corner: ID Tokens vs Access Tokens

ID Tokens represent a security token granted by the OpenID Provider that contains information on an end-user in your

system. This information tells the client application that a user is truly authenticated. Plus, it can also provide information such as their

username or locale. Systems can pass an ID Token around different client components. In turn, these components can use the ID Token to confirm user authentication and/or retrieve information on them.

What do I check when validating an ID token?

Generally, the validation process of an ID token comprises these steps:

- Retrieve and parse your Okta JSON Web Keys (JWK), which should be checked periodically and cached by your application. Decode the ID token in question, which should be in JSON Web Token format.

- Verify the signature used to sign the ID token.

- Verify any claims found inside the ID token.

Access tokens

Access tokens, on the other hand, don’t to carry information on the user. They simply allow access to certain defined server resources. These tokens generally have a short lifespan (a per their establish expiration) for increased security. In other words, when the access token expires, the user must authenticate again to get a new access token limiting the token’s exposure. Although not mandated by the OIDC spec, Okta uses JWTs for access tokens since the expiration is built right into the token.

FAQs for Backoffice notifications

Being on top of information flows is crucial to any business. That’s why support notifications is a standard feature at PayXpert.

➡️ Who do I notify if I have questions?

When you onboard as a PayXpert merchant, your business is assigned a Success Manager. However, most day to day issues can be addressed via the support ticketing system. For more complex issues, such as adding an alternative payment, please feel free to email your Suc cess Manager.

![]() If you don’t know who your Success Manager is, open a support ticket or email us at support@payxpert.com.

If you don’t know who your Success Manager is, open a support ticket or email us at support@payxpert.com.

➡️ Can I receive notifications when documents are created in my Backoffice accounting area?

Yes. Your Success Manager can create a backoffice system permission so you receive a notification if a document is created in accounting. This notification will be sent to the main email address you provide.

➡️ Do customers receive a message confirming their order automatically?

Yes, customers do receive notifications, if this feature is activated on your account. If you want to activate or deactivate this feature, please contact your Success Manager.