What is the payment solution for your retail business

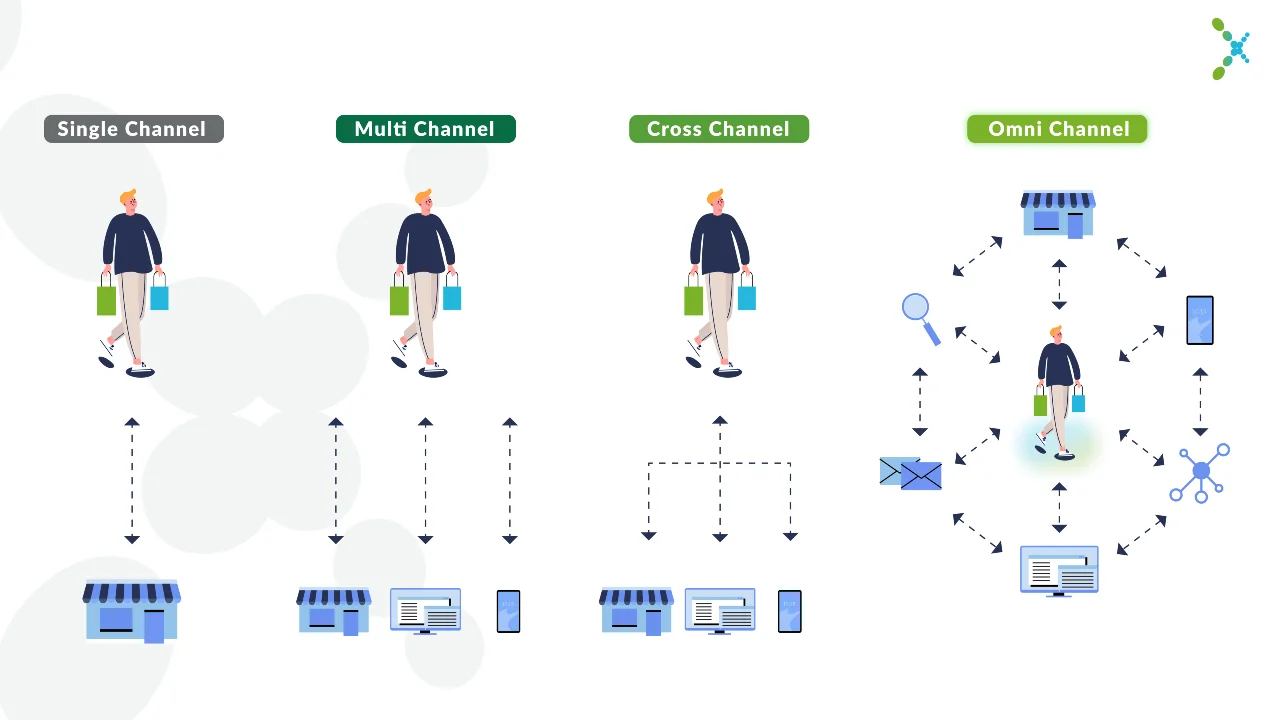

Think of the connectivity of your sales channels and payment solutions as steps on a ladder, 1. Single-channel, 2. Multichannel, and 3. Omnichannel.

To climb this ladder, it is not about “less is more” but more of everything, more channels, and more connections, ultimately resulting in more revenue. Don’t get stuck on the ground floor; take the necessary steps to elevate your business!

It all starts and ends with your customer, and shoppers today expect the same brand and payment experience in all browsing and buying channels. Increasingly more people use numerous channels in the buying process. A recent study from Harvard Business Review shows that 73% of retail consumers use multiple shopping channels. And the more channels customer use, the more value they bring. The larger the purchase, the more channels the buyer uses to gain information and feel comfortable about the decision.

81% of retail shoppers conduct online research before buying (Source: GE Capital Retail Bank). Whether your business is a restaurant, a hardware store, or a florist, you can count on the fact that your customer most likely found you online before continuing the journey towards a purchase. Naturally, the need for multiple digital touchpoints also translates to a need for multiple payment channels.

The Death of eCommerce

Not to worry, we are not suggesting that consumers will stop shopping online! What we do suggest, though, is that the omnichannel approach is becoming so prevalent that maybe it is time to stop referring to online and physical stores as “separate worlds”. It’s all commerce, selling and buying, and the customer journeys through virtual and physical channels choosing the most convenient path to purchase. A holistic approach to your sales channels will help you up “the ladder” to an omnichannel business.

So, what is the difference?

Our argument, then, is that it is not about choosing one or the other but how to transition from one to the other. Taking your business into new channels opens new possibilities and revenue streams. To fully capitalise, you need an Omnichannel approach. Various studies also show that there is not necessarily a standard sequence from online purchases to store pick-ups. Shoppers are just as likely to visit your store and get the item shipped home. This versatile approach to shopping only emphasises the need to have no weak links in your omnichannel chain.

The long-term benefit is increasing brand awareness and loyalty for your business. When your customers are greeted with a coherent messaging and shopping experience, and able to choose their preferred payment method, this will “stick” with them, and loyalty will start to build.

From Multi to Omnichannel User Experience

Multichannel communication (CRM, email, chatbot, social networks, webpage interaction, SMS, WhatsApp), multi-channel payments (PCI IVR, MOTO, Physical and virtual POS, facial recognition, pay-by-link, QR payments, etc.) combine with back-office systems to create this evolution. Omnichannel retailing is the most resilient business model today. Your customer expects freedom of choice and seamless interaction with your business.

Multi and Omnichannel Payments

Omnichannel payments are the result of the evolution of multichannel. While it involves interaction and payments with consumers through multiple channels, omnichannel represents a unified path to establishing customer relationships. A single centralised platform for all payment channels not only gives the buyer more control but the seller as well, as all transaction data and customer behaviours can be accessed in one view. At PayXpert, we have put much effort into making this “view” as panoramic and profound as possible with a Back-office for transaction data that is a powerful tool for controlling the KPIs of your business.

Payment methods

-

Virtual POS. It allows you to accept payments anytime, anywhere, using your mobile phone or the gateway’s POS.

-

MOTO is a Mail Order / Telephone Order solution that includes various features so Merchants or Call centres can efficiently and securely handle their payments without the need for extra developments or system integrations.

-

PCI IVR enables your online business to accept payments using interactive voice responses (IVR). PayXpert’s IVR solution and the users` phone numbers provided are covered by the PCI L1 payment data security.

-

Pay by Link allows you to send a link through any chosen channel (e-mail, SMS, chatbots etc.), and once the receiver clicks, she is taken to a branded, secure payment page.

-

Alternative Payments. What counts as an alternative payment varies from country to country. The basic premise is that your business can offer your customer’s preferred payment gateway. Your Chinese customers would greatly appreciate being offered the possibility to use WeChat Pay and Alipay, whereas Indian customers prefer RuPay.

-

QR Code payment functions similarly to paying by a link, as the customer is taken to a payment page, in this case, after scanning the code on a mobile.

-

Biometric payment uses physical characteristics to identify the payer. With facial recognition, the user just needs to “smile to the camera” to make a payment. No card swipe needed!

An overview of payment channels.

The Next Step: Unified Commerce

We have been singing omnichannel’s praises in this article, for a good reason! However, there is one more step on the ladder to optimising your business, unified commerce.

Whereas omnichannel links the many different digital and physical channels so that the customer experience is close to seamless, unified commerce is designed to ensure systems communicate and data flow freely. Integrating a centralised payment platform like what PayXpert offers into your digital business ecosystem will ensure that no part of the user experience or data flow remains outside of the unified model. This model is only complete when all customer-facing connecting points, POS, CRM, CMS, advertising, logistics etc., are aligned both in input and output.

There might seem to be, technically speaking, a seemingly small difference between omnichannel and unified commerce. However, the effect on the bottom line is substantial. The more your systems automatically interact with each other, the fewer resources are wasted, and the more attention is devoted to optimising the business. Unified commerce offers a single view of the customer, due to the data coherency, and this is a key factor to retail success in 2023 and beyond!