With the continuous development of global e-commerce and the impact of the pandemic on physical stores, consumer shopping habits have been rapidly changing. As a result, the live-streaming shopping industry in China has experienced significant growth in recent years.

In 2016, Chinese retail giant Taobao (Alibaba group) pioneered an innovative shopping approach by linking an e-store with an online live-stream broadcast, allowing customers to watch and shop simultaneously. This started the era of Live-streaming shopping, a shopping mode combining live video, real-time interaction, entertainment, and instant purchasing experiences. It has attracted a huge number of consumers in China with its unique charm.

This article shows the development trends and influences of live-streaming shopping in China and the insights European merchants can gain from it.

A rapidly growing channel with long-term potential

In recent years, live stream shopping has transformed the retail industry and established itself as a major sales channel in China.

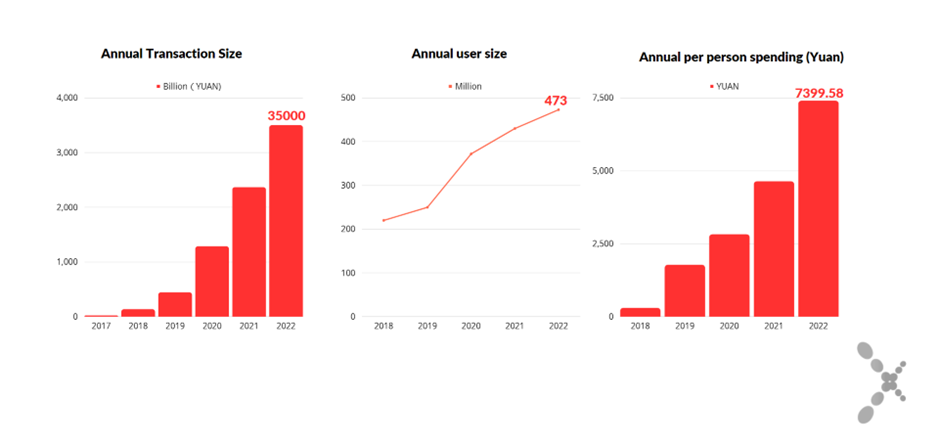

In 2022, the transaction volume reached RMB 3.5 trillion (≈ 459 billion in EUR). From 2017 to 2021, the transaction volume of China’s e-commerce market was RMB 19.64 billion, RMB 135.41 billion, RMB 443.75 billion, RMB 1.285 trillion, and RMB 2.36151 trillion, respectively.

In 2022, the user base of live-streaming e-commerce reached 473 million users, with user numbers for 2018 to 2021 being 220 million, 250 million, 372 million, and 430 million, respectively.

The growth rate of the user base reached its peak in 2020 due to the impact of the pandemic, reaching 48.8%. At the same time, in 2022, the average consumption per capita in the live-streaming e-commerce industry was RMB 7,399.58. (≈ €970) The average annual consumption amounts for 2018 to 2021 were RMB 296.95, RMB 1,775, RMB 2,822.58, and RMB 4,639.68, respectively.

According to the management consultancy firm McKinsey, live-streaming accounts for 10% of Chinese e-commerce revenue.

Advantages of live-streaming shopping compared to traditional e-commerce:

1. An interactive presentation of the product information.

As an innovative shopping method, live streaming allows consumers to see the most authentic product presentation in the live stream, eliminating the reliance on traditional text and image information when shopping online.

Products can be displayed more intuitively to consumers, allowing them to understand product details through live presentations; combined with the two-way communication between hosts and viewers in the live stream, where viewers’ questions about the products can be promptly addressed, allowing consumers to resolve doubts during the live stream thus encouraging them to place instant orders.

2. A smoother shopping experience.

Live stream shopping allows consumers to enter live streams easily for various reasons, such as a promotional event, following a famous host, or just passing the time by watching a live stream for entertainment purposes. Consumes enjoy immersive experiences where they can receive all product information instantly and interact with the host through a chat function or reaction buttons.

Additionally, sharing product links within the live stream interface allows consumers to purchase easily. Live streaming offers consumers convenience and the feeling of being catered to, sometimes, by their famous idol as the host. Gen-Z has become the main consumer force, so they are especially keen on innovative shopping formats and experiences.

In contrast, traditional e-commerce shopping requires consumers to seek information actively-search for product information on different platforms, compare prices, examine product details, and purchase after reading reviews.

3. Price advantage that stimulates impulse shopping.

Consumers choose to shop in live streams not only for better shopping experiences but also because they believe that the prices in live streams are more favourable. Live-streaming e-commerce often promotes products directly provided by factories and thus is perceived by many consumers as the shopping channel for low prices and good deals. Some famous hosts also negotiate with brands to get discounts for their audiences, boosting their influence and success.

Other time-limited discounts or coupons are also widely used on the live stream. These are extremely effective because the sense of urgency is emphasised due to scarcity or limited availability. Those limited-time offers and supply stimulate consumers’ “snatch up” behaviour, as it plays on consumers’ fear of missing out on good deals.

4. The Key Opinion Leaders (KOLs) Effect.

KOL, short for Key Opinion Leader, plays a significant role in the decision-making process of Chinese consumers when it comes to purchasing. Hosts use their unique communication styles and expertise in specific fields to introduce product features to customers, provide detailed insights and recommendations on product usage, and make live-streaming shopping more entertaining through humorous approaches; trust in the host is key.

Consumers trust the expertise of these hosts. Most consumers enter live streams with a mindset of “learning” and “observing,” allowing them to gain knowledge about relevant products and industries while spending their leisure time.

How can European and UK merchants win the favour of Chinese consumers?

1. Utilise popular social platforms in China and combine them with a live-stream format if possible.

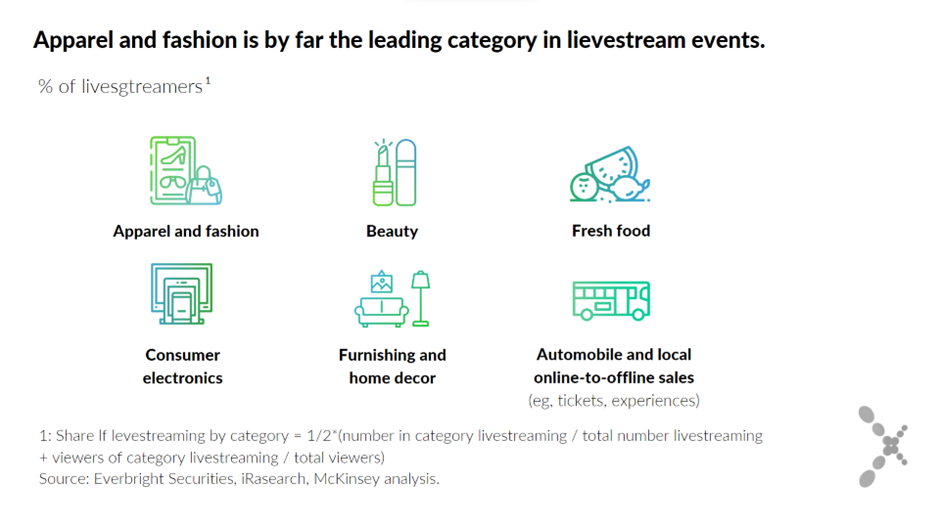

Merchants shall consider trying out popular social platforms in China and utilise those platforms as important channels for promotion and sales. What’s more, to adapt to live stream format, it’s a reliable digital tool for boosting customer engagement and sales conversation where you can easily influence customers’ journey from awareness to purchase, and it pulls in additional web traffic. It’s also a great approach to increase a brand’s appeal and distinctiveness, especially for beauty and fashion businesses, which are mostly showcased in live-stream shopping. According to Mckinsey analysis, the breakdown of items featured on China’s livestream platforms is as follows:

2. Consider the KOL effect for marketing campaigns.

Merchants can leverage the inherent influence of “Key Opinion Leaders” (KOLs) to increase the conversion rate and consumers’ trust in the brand. Often, KOLs serve as customer service representatives for their audiences, building audience loyalty and liaising between buyers and brands.

For example, the biggest names in live shopping are seen as having reliable opinions on the products they sell; those hosts hold the power to sell out products in seconds, raking in millions of dollars every stream. One of the most successful hosts Li Jiaqi, has tens of millions of followers and is known for his enthusiastic catchphrase: “Oh my God, buy it!”.

Smaller KOLs have less bargaining power when negotiating commissions for themselves or discounts for their audiences compared to top-level KOLs and celebrities. Yet, smaller KOLs can provide brands with stronger loyalty and more favourable margins. In addition, smaller KOLs normally have a more defined community than larger KOLs, allowing more precise and targeted marketing strategies for brands.

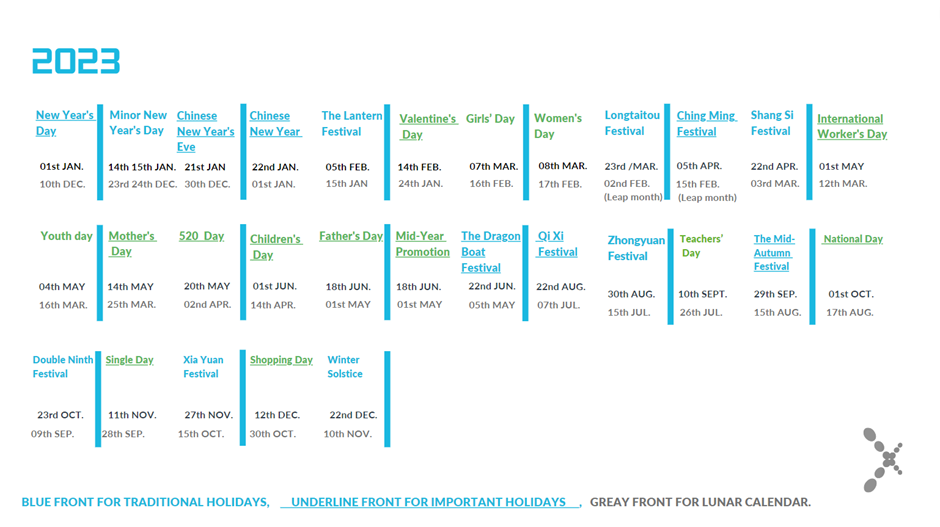

3. Consult the Chinese holiday calendar

Chinese customers love shopping during holidays, including the most famous shopping festivals, such as 6.18, 11.11, and 12.12. as well as traditional holidays, such as Chinese New Year. We share this calendar below for you to take advantage of those golden sales periods.

4. Implement a Chinese payment system.

Consumers are always more willing to pay through their most familiar and favoured payment methods. In China, where mobile payments are dominant, most of the payments are made by WeChat Pay and Alipay+. Integrating a Chinese payment system would allow Chinese consumers to make payments more seamlessly, thus increasing the checkout experience and conversion rate.

Source: WJS (100EC), ASKCI, Mckinsey analysis.