The dream of every international business is to optimize its global sales by making it as easy as possible just because: the simpler, the better.

How to do it? With world-class financial consultants, such as PayXpert. Thanks to its payment management and financial optimization tools, the world market is within the reach of all kinds of companies, regardless of their size.

In this article, we explain how to process international payments in the most efficient way: through local acquirers.

What is an acquirer?

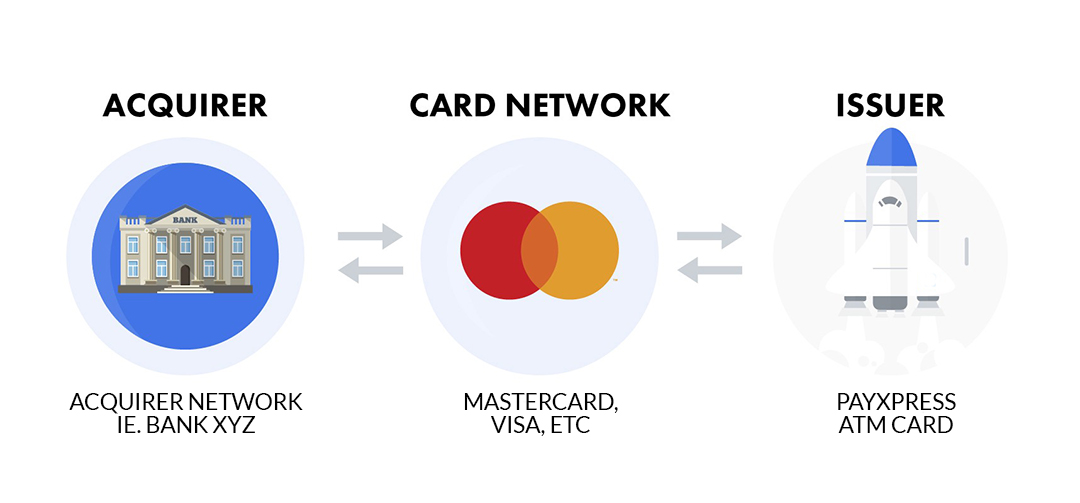

Let’s start from the basics. An acquirer is a bank that processes card payments (either credit or debit) on behalf of a business. For that purpose, it requests authorization from the bank of the person making the purchase (issuer) through the card used (Visa, MasterCard, American Express…).

How are international payments managed?

Let’s assume that you are a company based in the United States, and a buyer from Spain tries to buy from your e-commerce portal. Your US acquirer will request authorization from the Spanish bank for the transaction. Several things can happen here:

- Your acquirer is unusual for the issuing bank in Spain, which does not recognize it and denies the disbursement authorization. Your Spanish client is not able to buy your products and ends up discarding your brand, along with clients from all over the world.

- Your acquirer has local licenses in different countries around the world (including Spain). It sends a transaction request to the issuing bank in a local and recognizable format. Finally, it is recognized and your client in Spain can make the purchase in a comfortable and simple way.

In this type of scenario, it is quite clear which of the two cases is the one you want for you and your business. And this is where the role of PayXpert comes in to help you optimize your international sales. Did you know that through a locally licensed acquirer you get up to 21% more successful transactions? At PayXpert we can and want to be the travel companion that helps you consolidate your global market (if you already have it), or fulfil your dream of expanding the borders of your business. In addition to the most extensive network of local acquirers in the industry, we offer the latest tools to that you can closely follow your conversion cycles and take the best decisions as soon as possible.

Furthermore, we provide coverage to multiple payment systems around the world: from the most common (Visa, MasterCard, etc.) to those that will open the doors to the Chinese and Russian markets (The Indian RuPay system, AliPay and WeChat Pay in China). In short, it is a way to simplify how you understand the finances of your business and break into an emerging international market with billions of new potential customers.