If you run a business, you know that payment is the most important moment in the buying process. The value delivered to the user experience and customer satisfaction depends to a large extent on it.

Traditionally, banks or licensed payment companies have established business relationships with card networks (Visa, MasterCard, Discover, UnionPay, American Express, Japan Credit Bureau (JCB) to offer merchants an account and process credit and debit card transactions.

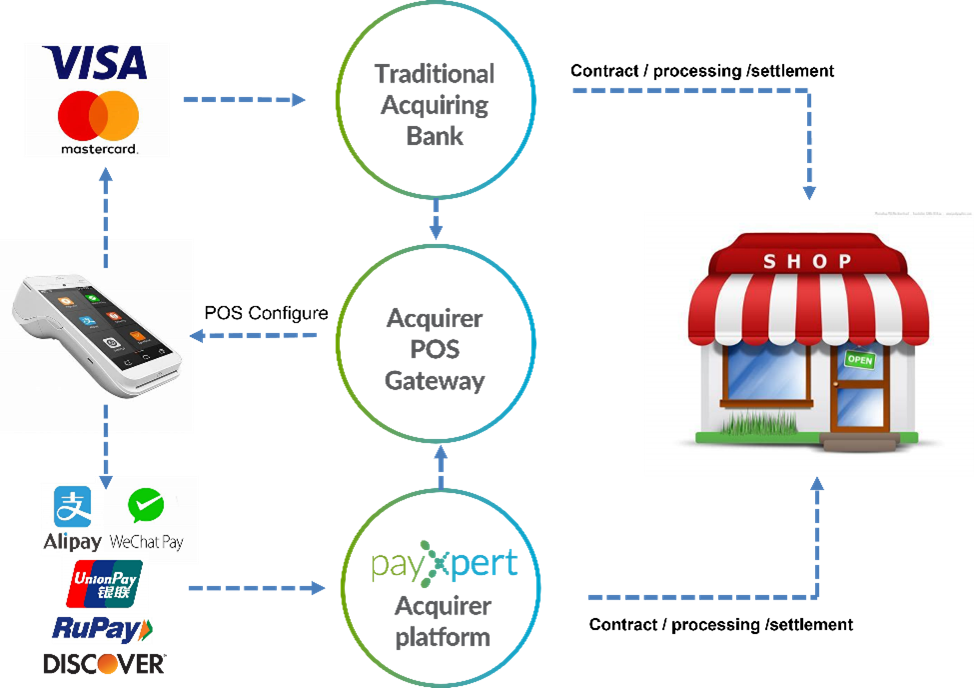

However, becoming an acquirer of a card network is a complex process that requires technical systems integrations and certifications, as well as merchant contracts before processing any transactions. Each payment channel offered by the acquirer requires independent development, integration, and testing for each card system.

The complexity of the process means that many acquirers do not offer merchants the full range of international payment methods available. So how can acquiring banks, payment gateways, and point-of-sale manufacturers benefit from partnering with PayXpert?

What is acquiring?

It is the process whereby a bank or company establishes a business relationship with card networks to offer an account to merchants to process credit and debit card transactions.

Acquiring banks, payment gateways, and point-of-sale manufacturers, among other payment processing companies, can benefit from partnering with PayXpert.

PayXpert Acquiring Services

Being an acquirer is synonymous with customised international payment processing for your business, reaching more markets, and taking advantage of the most advanced features with a single payment platform.

However, many banks and companies face numerous challenges when acquiring new payment channels (MOTO, physical POS transactions, eCommerce transactions, etc.). For this reason, some acquirers do not offer merchants all available payment methods, or simply offer some card network options in certain payment solutions. For example: having a merchant account enabled for online merchant transactions but not for physical POS transactions.

This is where PayXpert’s acquiring service can help merchants, traditional acquirers, point-of-sale integrators, and payment gateways.

Acquiring for merchants

PayXpert can offer direct merchant accounts for both eCommerce and physical POS transactions.

For MasterCard and Visa payment acceptance, PayXpert uses its financial license to partner with acquiring banks and offer direct merchant accounts to its merchant customers.

For other popular international payment methods like UnionPay, Discover Card, RuPay, Alipay, and WeChat Pay, PayXpert has become a member of these payment schemes and can offer merchants the ability to accept all these important payment solutions.

For the merchant, it eliminates the friction of searching for banks and acquirers that can incorporate the full range of international payment methods available.

Acquiring for acquirers and point-of-sale integrators

PayXpert can partner with your acquiring business to improve your ability to offer a wide range of international payments methods through your eCommerce and physical point-of-sale products.

As a direct member of popular international payment methods like UnionPay, Discover Card, RuPay, Alipay, and WeChat Pay, PayXpert can help more traditional acquiring banks support these important payment solutions on both your eCommerce payment gateways and on physical android POS devices.

We can help acquirers certify their android POS devices to support these payment solutions, process the merchants’ transactions, and provide the merchant settlement and reconciliation services.

Our payment gateway is designed to help merchants and acquirers improve and increase the payment methods they offer to their customers.

In addition, we can direct domestic transactions to partner acquirers in Germany, France, Spain, and the United Kingdom to ensure processing at the lowest possible cost.

When you need to conduct physical POS transactions, we work as a direct acquirer with a number of POS hardware manufacturers to certify the new Android POS, including Castles, Newland, PAX, and Sunmi, for different payment schemes.

We can partner with acquirers and integrators and add our certified payment methods to their point-of-sale devices. The goal is to offer the most competitive POS payment solutions in the market.

PayXpert’s omnichannel payment processing services

Something is changing with the impact of new technologies. Digital payment methods are key to the smooth running of any eCommerce. However, there is no point in offering an unknown payment option to users.

What is known will always give a sense of confidence to any human being. Your customers will choose their favourite payment method when their money is at stake.

It will always be better for your business to offer, for example, WeChat or AliPay to Chinese customers and RuPay to Indian consumers rather than unknown payment options. Whatever payment method you offer, it can coexist with other options on the same payment gateway.

The omnichannel strategy is about offering different payment methods(AliPay, WeChat, invisible payments) in different channels (POS, MOTO, mobile payments) and managing them from a single platform (payment gateway).

PayXpert’s omnichannel payment processing services integrate all business management into a single digital platform. As a result, the interaction between your business and your customers is unified across different channels and payment options.

Direct card scheme processing solutions

International card payments are a must to increase sales. Today, more than half of global online transactions are carried out by card. If you have an eCommerce or physical store, you need to accept credit and debit cards from your customers.

With our acquiring network, you can easily process card payments from your customers worldwide. You only need to connect to our platform through a single integration.

Multi-acquiring payment schemes on single point-of-sale devices

We help you certify your POS terminal with the world’s leading card networks. Your POS can be certified to accept all global and local payment methods in compliance with the latest payment processing regulations.

Working with PayXpert not only ensures the best timelines to move forward with your POS device certification but also selling in any market.

Now, you can welcome international buyers with their local cards, making them feel at home through the payment options they are familiar with.

Key findings on PayXpert’s Acquiring Services

We create the best payment experiences for our partners, for our merchants, and for their customers. We constantly innovate in payments technology for businesses and subject our solutions to the strictest requirements in terms of quality standards.

PayXpert is a fintech and acquiring bank that has become a direct member of UnionPay Discover, RuPay, Alipay, and WeChat Pay.

Why choose our acquiring services?

Quite simply, we have a wide range of international payment methods, partners, and direct merchants’ settlement solutions. We support physical POS and eCommerce transactions, certify your POS for all major payment systems, reduce implementation and certification costs, and accelerate your speed to market. We continuously support new payment solutions, such as credit card, debit card, and QR code payments, and we accelerate your payment acceptance strategy.

We offer both direct merchant accounts and unique payment partnership opportunities for third-party acquirers, POS integrators, and payment gateways.