Technology and the digital age are triggering major changes in all sectors of the economy. The application of technology in the financial sphere has given rise to the fintech phenomenon, which comes from the English words financial technology and refers to the union of digital technologies and financial services.

Within the fintech framework, we find many different areas, also called verticals, ranging from alternative financing, cryptocurrencies, and personal finance to payment methods, transactional services, and neobanks, among others.

This post focuses on the payment methods segment, where a real revolution is taking place due to the emergence of new alternatives (digital wallets, blockchain platforms, phone bill payments, etc.).

Why is it the main fintech vertical in 2021?

The revolution of payment methods in the world

The impact of fintech on payment methods has triggered a revolution due to the emergence of new digital alternatives, such as e-wallets or P2P (peer-to-peer) platforms. To this phenomenon, we must add the public health crisis caused by COVID-19, which has put the global economy in a situation of uncertainty.

In the payments sector, a series of trends in the behavioural habits of consumers and businesses have accelerated:

- Increase eCommerce purchases.

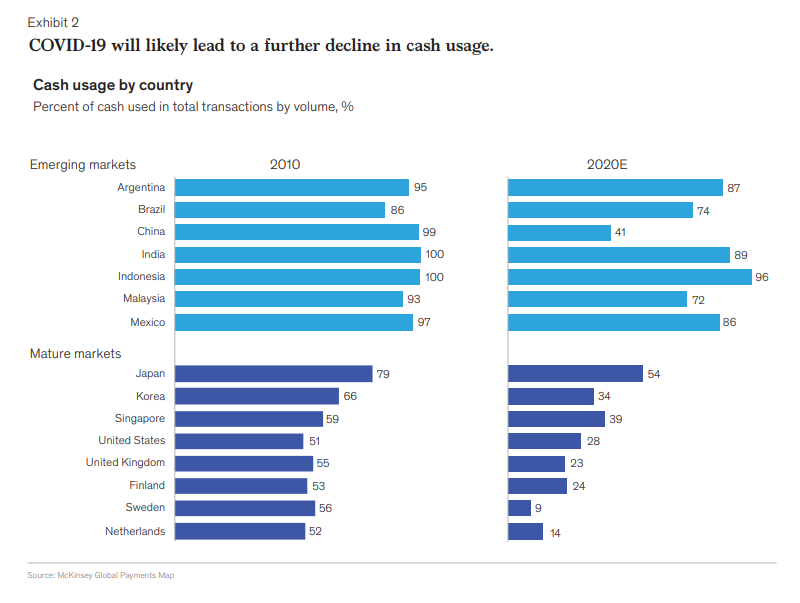

- Reduced use of cash.

- Increased use of digital payments (including contactless).

- Increase in instant payments.

In short, half a decade’s worth of change has taken place in just a few months in areas that are slow to evolve, such as payment operating models. However, the changes were not uniform across sectors or geographies during the first half of 2020, according to the McKinsey Global Payments Report:

- Switzerland increased the share of debit card spending from 65% to 72%.

- In Australia, the share of credit cards in total card spending fell by five percentage points between February and June.

- In Asia, alternative, instant and mobile payments increased, while credit cards maintained their position.

- In Germany and the United States, there were peaks in cash withdrawals in the days before the shutdowns due to the initial wave of COVID-19.

- In India, ATM usage fell by 47% in April.

- In the UK, the same rate fell by 46% per month on average between March and July.

In Europe, differences in shopping behaviour between countries narrowed dramatically, as many older consumers turned to online shopping for the first time.

However, the COVID-19 pandemic has not been the only trigger for the financial technology revolution. Long before that, changes brought about by blockchain technology, artificial intelligence, the internet of things, and quantum computing began.

Payment methods as the main vertical fintech

Payment methods as the main vertical fintech

Payment methods include all those entities whose main objective is to provide payment services, mainly online, through mobile devices and electronic platforms. It is the most relevant segment within the fintech sector and includes:

- Mobile payments. 70% of Spanish online shoppers made purchases from their mobile phones in 2020. Half of these internet users opted for fashion-related items.

- eCommerce. It has been a turning point in shopping habits, with smartphones becoming the most widely used device to make payments.

- Personal finance. Automated investment services and Robo Advisors, or financial advisors offering online investment portfolio management services are on the rise.

- Alternative finance and lending. Crowdfunding and peer-to-peer lending platforms are experiencing a major boost in Spain, especially in the real estate sector.

Local payment schemes going international, the rise of APM (Application Performance Management) software that reduces merchant processing costs and opens up new markets, the development of mobile POS, contactless payments, and QR code, among others, are also part of this revolution.

Not surprisingly, payment methods are at the forefront of the fintech phenomenon. The emerging economies of countries such as Brazil, Russia, and China are experiencing very rapid growth and the highest penetration of digital payment methods.

On the one hand, China is the largest fintech market in the world thanks to its leadership in digital payments. On the other hand, the United States ranks second due to the powerful innovation in financial technology.

How do payment methods influence the younger generations?

Payment methods in the younger generations

Beyond the technological evolution and the behavioural changes generated by the COVID-19 pandemic (reduction in the use of cash, less cash withdrawals at ATMs, increase in contactless and increase in eCommerce purchases), we must highlight the importance of social aspects as a driver of change in the sector.

The new generations X and Z are increasingly familiar with the use of technology and are looking for immediate services. Millennials and centennials are likely to increasingly rely on payment services and non-traditional financial service providers. This not only generates a change in consumer behaviour, but also attracts the attention of new competitors.

Examples include Asian giants Alibaba or Tencent, whose technology platforms continue to innovate to provide an excellent user experience. For example, Tobao, China’s largest eCommerce platform, plans to create retail stores to attract young consumers.

Payment methods today

Innovations in the payment sector range from transaction services, such as payment gateways, to traditional media, such as cards and physical POS.

Two of the most widely used means of payment today are:

- Digital wallet. This is the electronic version of physical wallets and allows financial transactions to be carried out through electronic devices. It stores valuable information for making payments, such as bank account information or credit and debit card details. We can distinguish between online wallets (allowing payments to be made through remote electronic devices without requiring physical interaction) and mobile wallets (they operate with contactless electromagnetic technology known as NFC, QR codes or Bluetooth).

- P2P transfer. This involves sending or receiving money between individuals through the internet (mobile applications, mobile banking or social networks) and through computers or mobile phones. Its requires linking a card or bank account to an application. Sending the transfer is quick and easy, you just need to select the beneficiary, add their email or phone number.

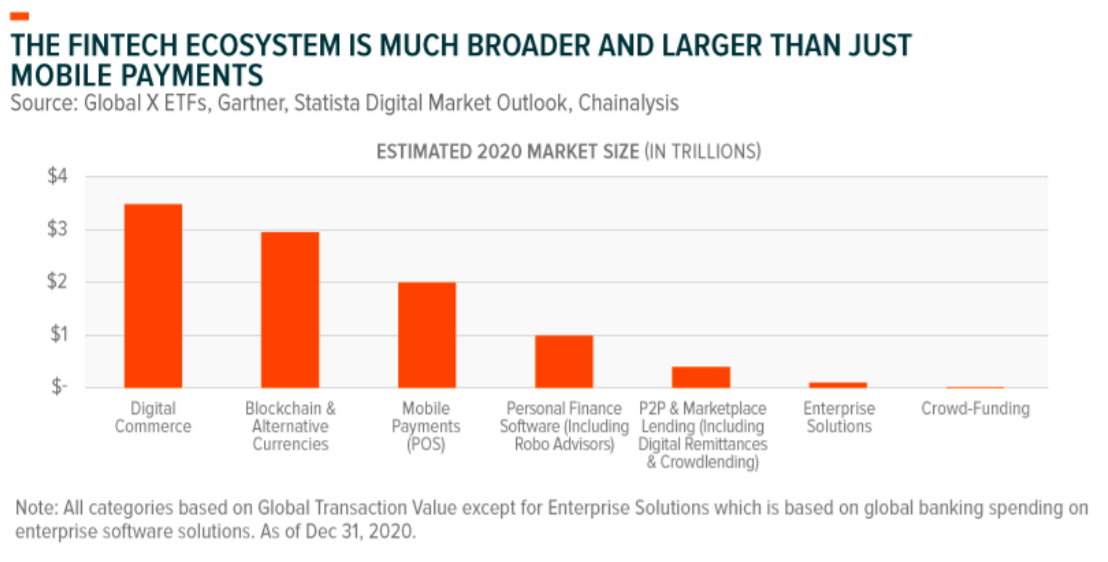

Although mobile payments are currently the main fintech vertical, this ecosystem is much broader.

Source: Global X

Source: Global X

Payment methods alone cannot cope with the disruption of financial technology. In fact, there are other financial trends driving the long-term growth of fintech, such as Buy Now Pay Later (BNPL) services and enterprise cloud solutions for financial firms. (Global X)

Do you want to learn about other fintech segments? Follow us every week on our blog.