Do you collect payments from customers in different countries on a daily basis? Does everyone use a different payment method? Increase the control of your transactions with the security offered by PayXpert. This payment platform allows businesses and merchants to access specific solutions, such as WeChat, AliPay or MIR, to meet the growing tourism needs of countries like China or Russia.

Furthermore, this payment gateway has a variety of additional services that serve to analyse all transactions, optimise rejected operations and monitor your customers and business in general. If you want to know more about how it works, we encourage you to read this post.

Let’s get started!

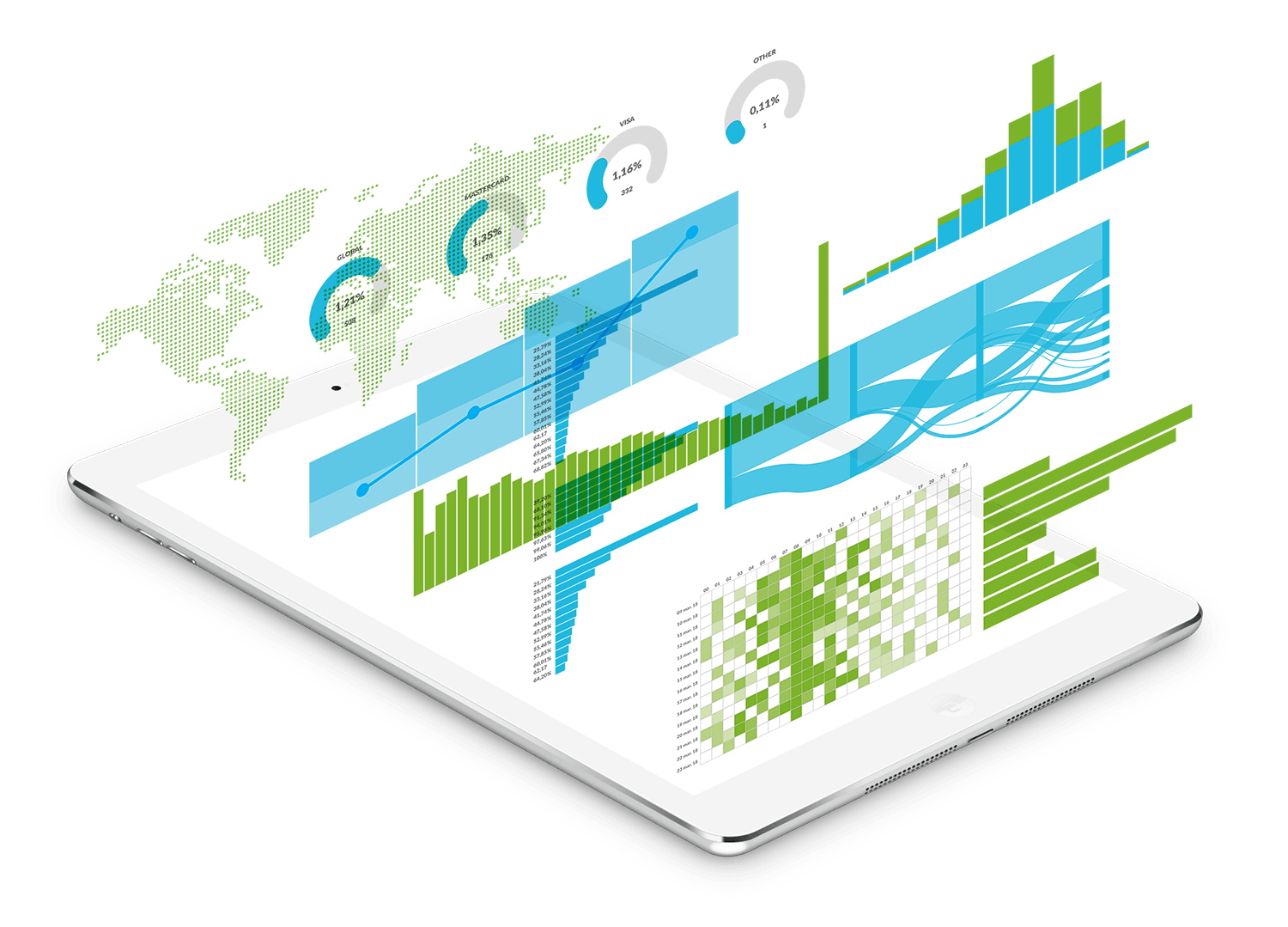

A dashboard to control your eCommerce transactions

How many collections do you manage in your business each day? Fraud risks in e-commerce are on the agenda everyday. Protecting yourself is vital to your business’ success. That’s why PayXpert offers a dashboard in which you can:

- Analyze all transactions.

- Control the payments made by your customers.

- Optimize rejected transactions.

- Track eCommerce.

- Understand user behavior with consistent and interpretable graphics.

- Access limited lists of filtered transactions from the statistics section you want to analyze. Compare current business results with previous ones.

- Save time. The PayXpert dashboard graphically displays the financial performance of your eCommerce: sales, transactions, risk rate, etc., making it easier to make decisions, reducing the time you spend on studying and analyzing the data and therefore speeding up the entire process.

- Improve your business. And you get an optimized version of it, more organized and intuitive. Collecting your consumer data allows you to create organized and interrelated interest profiles, trends and buying habits to obtain easy-to-read statistical results.

- Cut down uncertainty. By having an organized database, you can easily draw conclusions, know in depth all the processed payments, and have a much clearer and organized view of the business, which guarantees a reduction of chargebacks and peace of mind for your team.

- Save costs. Above all, since you do not need to hire different suppliers. PayXpert integrates everything you need to offer your customers the payment method they use in their home countries, and to optimise the financial and personnel costs related to your collections, among many other functions aimed at optimising the business’ costs.

Now you can control your business with just one click – are you ready to join the payments revolution?

Main difficulties in collection management:

PayXpert is one of the few payment service providers that focuses on data management for a global business view. In this way, you can make informed decisions about your activity and obtain added value.

The greatest challenge that online stores face when it comes to controlling their collections is the number of providers they need to cover their requirements: reconciling finances, charging customers from different countries, adapting payment methods, controlling transactions, distributing their sales in different media, and providing the best possible user experience.

As a company focused on merchants and their customer’s payment experience, PayXpert is the innovative answer that unifies all these solutions in a single platform, avoiding the need to hire multiple providers. Gain flexibility and efficiency in the payment chain!

Advantages of having your payment information centralized

Payment gateways have become one of the most important trends for e-commerce, and the advantages of having a control panel to manage your company’s data are:

A good data management will allow you to have a clearer view of the eCommerce activity, access to financial information at any time and place, and manage your customers’ data in the most useful way for your business.

Are you committed to a future investment?

Why is it important to control your eCommerce payments?

Users are concerned about placing their purchase data on the Internet, so eCommerce must offer effective and secure payment methods that increase customer confidence. Security, not being able to touch the product, nor see the staff, create an uncertainty that has marked the activity of eCommerce since its origin.

The most direct and effective way to put an end to these concerns is to have secure online payment methods adapted to your needs, as well as having a platform from which to control the business in general and the transactions in particular.

For example, leaving the payment methods offered by the ecommerce in plain view is another of the points of conversion growth to be taken into consideration. The more payment options we have activated, the more attractive it will be for consumers to make a purchase on our site.

The payment process should be very simple, friendly and fast. Think that if someone has reached the time to give their personal data is because they have real interest in spending money on your eCommerce.

If an user has taken his time in deciding what he wants to buy in your page, has taken it to his shopping cart, has created his account and then prepares to pay but it has not been able to carry out the operation, what do you think he will do? Most likely, after a bad experience, he will leave without buying. That’ s why having a good payment gateway in your company is decisive.

Thinking about how we are going to charge our clients is fundamental. Of course, this decision will depend, to a large extent, on the flexibility of our platform. Whatever product or service you sell, payment is an essential process. Take care of it.