The Mid-Year Shopping Festival, or the 618 shopping festival, is one of the most significant events in the Chinese e-commerce industry. Initially founded by JD.com to celebrate the company’s anniversary, it has gained increasing influence over time with China’s massive consumer market and the rapid development of the e-commerce industry.

Gradually, it has transformed into a nationwide shopping festival, attracting consumers with discounts, promotions, and special offers. This event provides consumer shopping opportunities and serves as a platform for brands to promote their products and expand sales through a golden timing.

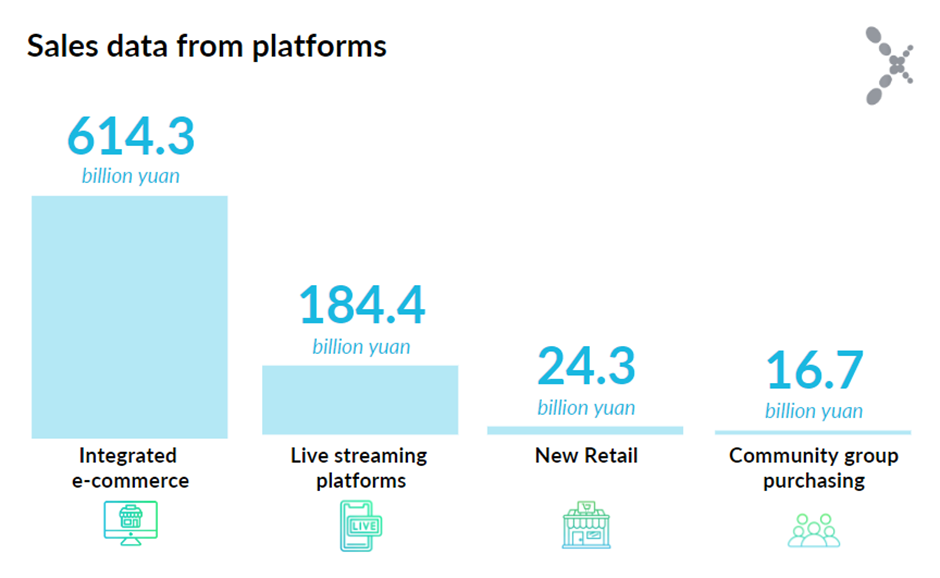

Performance of Major Platforms in the 2023 Shopping Festival: According to data from May 31st to June 18th, 2023, the cumulative sales revenue on Integrated e-commerce and live-streaming platforms reached 798.7 billion yuan( ≈100B in Euro, 87B in GBP). The total sales revenue on e-commerce platforms reached 614.3 billion yuan ( ≈77B in Euro, 67B in GBP)., with a participation of 674 million people in this shopping event.

Tmall occupied the highest sales volume, followed closely by JD.com, while the emerging e-commerce platform Pinduoduo ranked third. The most remarkable highlight of this promotional activity was the cumulative sales revenue of live-streaming e-commerce, reaching 184.4 billion yuan ( ≈23B in Euro, 20B in GBP ), Douyin (the Chinese version of TikTok) topped the sales on live-streaming e-commerce platforms, followed by “Dian Tao” and “Kuaishou.”

Data source: Syntun

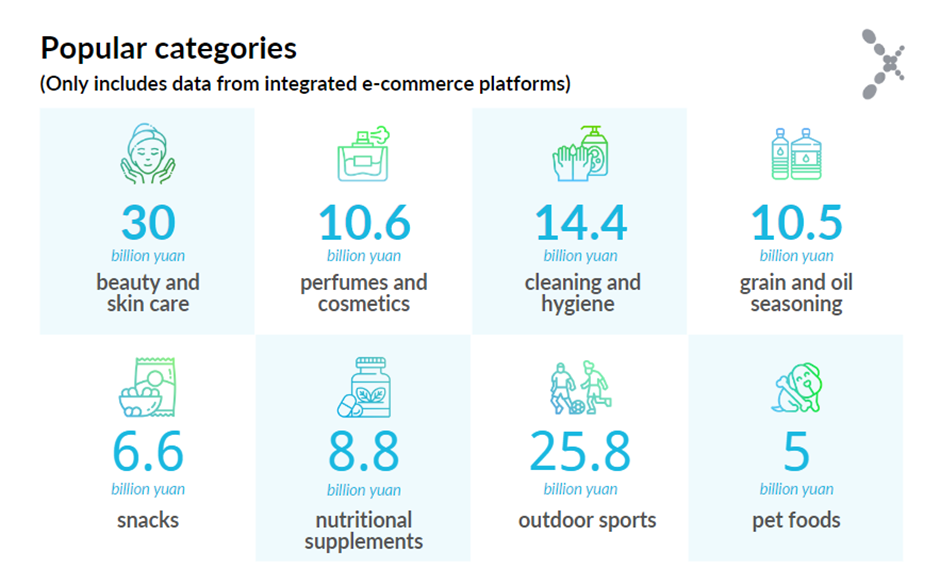

Overview of Popular Sales Categories and Brand Sales Data: During the event, the sales revenue of the beauty and skincare category reached 30 billion yuan (≈3.76B in Euro, 3.27B in GBP), with the highest sales from brands such as L’Oréal, Lancôme, and Estée Lauder.

The sales revenue of perfumes and cosmetics reached 10.6 billion yuan (≈1.33B in Euro, 1.16B in GBP), the sales revenue of cleaning and hygiene products reached 14.4 billion yuan (≈1.8B in Euro, 1.57B in GBP), the sales revenue of grains, oils, and seasonings reached 10.5 billion yuan (1.32B in Euro, 1.14B in GBP).

The sales revenue of snacks reached 6.6 billion yuan (0.84B in Euro, 0.72B in GBP), the sales revenue of nutritional supplements reached 8.8 billion yuan (≈1.1B in Euro, 0.96B in GBP), the sales revenue of outdoor sports reached 25.8 billion yuan (≈3.24B in Euro, 2.81B in GBP), and the sales revenue of pet foods reached 5 billion yuan (0.63B in Euro, 0.55B in GBP).

Data source: Syntun

Consumer Development Trends:

- Beauty and Skincare Industry – Consumers pay more attention to product ingredients.

With the popularity of live streaming and skincare knowledge-sharing platforms like XiaoHongShu, consumers care more about understanding the ingredients, efficacy, and suitability of beauty and skincare products. They also make more informed and rational choices when purchasing beauty and skincare products, seeking products with multiple combined benefits to achieve better skincare results. - Rise of the “Scent Economy”

Perfumes account for 30% of the online cosmetics market. This phenomenon indicates that Chinese consumers have a more comprehensive definition of “beauty.” The younger generation believes choosing the right perfume for different occasions can create an atmosphere showcasing individuality and charisma.Additionally, consumers believe that scents can evoke memories and positive associations, providing comfort and inspiration. A similar trend is prevalent in the cleaning and hygiene industry, where consumers increasingly seek products with pleasant fragrances, considering the scent equally important as the cleaning efficacy.

- Pursuit of Healthier Lifestyles

Post-pandemic, the concept of overall health has become more tangible, and consumers are looking to use food to prevent and treat diseases. Therefore, consumers prioritise products with no additives, low salt, and low oil content in grains, oils, and seasonings.

Furthermore, as the main force of consumption, young consumers tend to choose products that require less complicated cooking. In the snacks category, consumers seek delicious and healthy products, paying attention to not only the taste but also the nutritional content and additives of the snacks.

Nutritional supplements have become popular as consumers increasingly focus on their physical well-being, aiming to boost immunity, shape bodies, and maintain gastrointestinal health. Additionally, there has been a noticeable growth in the sales revenue of sports and outdoor equipment, with consumers preferring lightweight outdoor activities such as frisbee and camping gear.

Young consumers are particularly interested in activities that combine social, emotional, and health values, favouring those that are easy to engage in and offer opportunities to make new friends.

In this era of digitalisation and globalisation, understanding consumer trends and sales data in various markets is crucial for businesses. In the post-pandemic era, understanding the changing trends in the Chinese market has become even more critical. The next step is to combine it with a well-target marketing strategy on Chinese social media*.

Data source: Syntun

* Services provided by PayXpert Spain (B66786617), Av. Diagonal, 440, 7, 08037 Barcelona